New Zealand has a public healthcare system that treats acute health conditions and provides some elective surgery. We also have a public, no-fault accident insurance scheme Accident Compensation Corporation (ACC) covering accidental injury.

These are effective in providing healthcare support for accidents, and acute and urgent care. But public hospitals cannot do everything for everyone.

Southern Cross Health Insurance (Southern Cross) policies complement these public services by making private healthcare available.

In an effort to support our members when they undertake an ACC review, the Southern Cross member advocacy team is there to help. There is no charge for this service for our members.

How we work with ACC – the Southern Cross member advocacy team

Like you, Southern Cross cares about the health and wellbeing of our members. The Southern Cross member advocacy team offers an advocacy service to our members who may have been incorrectly declined cover by the ACC in relation to a personal injury caused by an accident, medical treatment injury or gradual work-related injury. There is no charge for this service for our members.

The Southern Cross member advocacy team will guide the member through the process of an ACC review, providing knowledge of the system and support with the goal of having their ACC decline overturned and the treatment funded by ACC. If successful, the member will be able to request backdated compensation and other entitlements from ACC.

John's story

Our member John is grateful for the help he received with his declined ACC claim from the Southern Cross member advocacy team. To see how the member advocacy team can help you, watch John's story here.

Who covers what?

ACC has three categories of cover which are treated differently by both ACC and Southern Cross; personal injury caused by an accident, gradual work-related gradual process injury, and treatment injury.

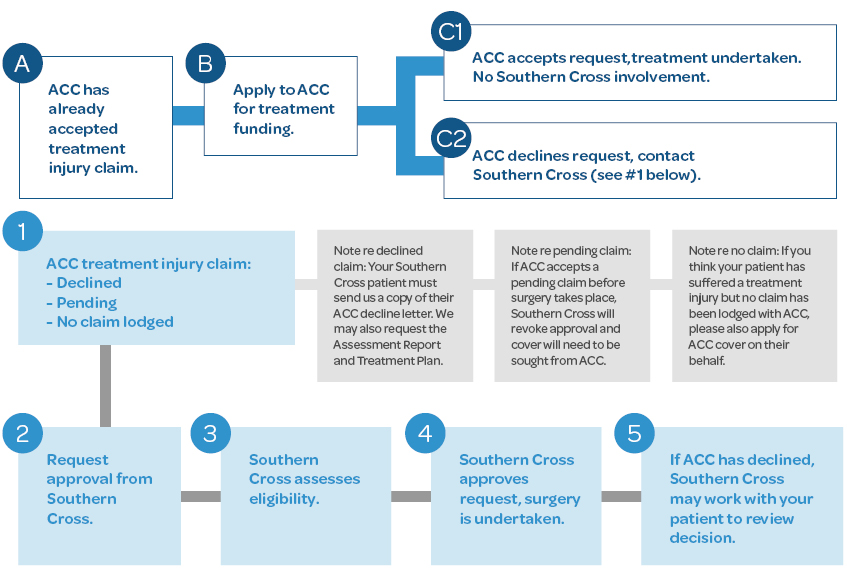

Southern Cross policies do not cover treatment for injuries which are accepted for cover by ACC. If your patient’s treatment relates to an injury that ACC has agreed to cover you must apply to ACC for treatment funding in the first instance.

In some cases, ACC will not pay the full amount charged for treatment (ACC surcharges and partial payments). In these cases, the member may be able to claim the remainder under their Southern Cross policy.

Are you covered?

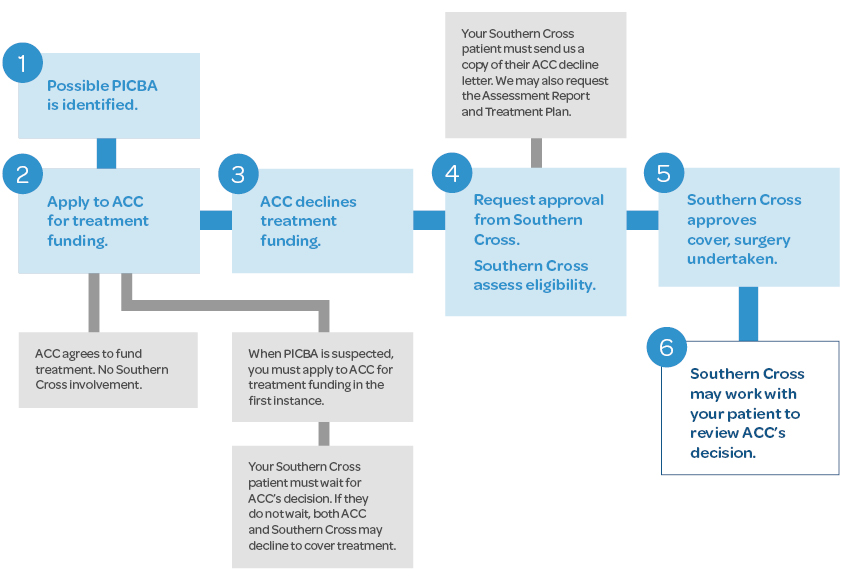

If ACC declines to cover PICBA treatment for Southern Cross members

If a member is declined by ACC and the treatment they require is covered under their Southern Cross policy, Southern Cross may agree to cover the cost of that treatment. The Southern Cross member advocacy team may also work with the member to apply for a review of ACC’s decision. A review can take place either before or after treatment is provided and will not delay access to treatment.

If you or the member think that ACC’s decision is incorrect, please encourage them to make contact with the Southern Cross member advocacy team. We will review the decline documentation and offer advice as to whether a review of ACC’s decision is warranted. If the decision is reviewable, the Southern Cross member advocacy team can work with the member to guide them through the review process.

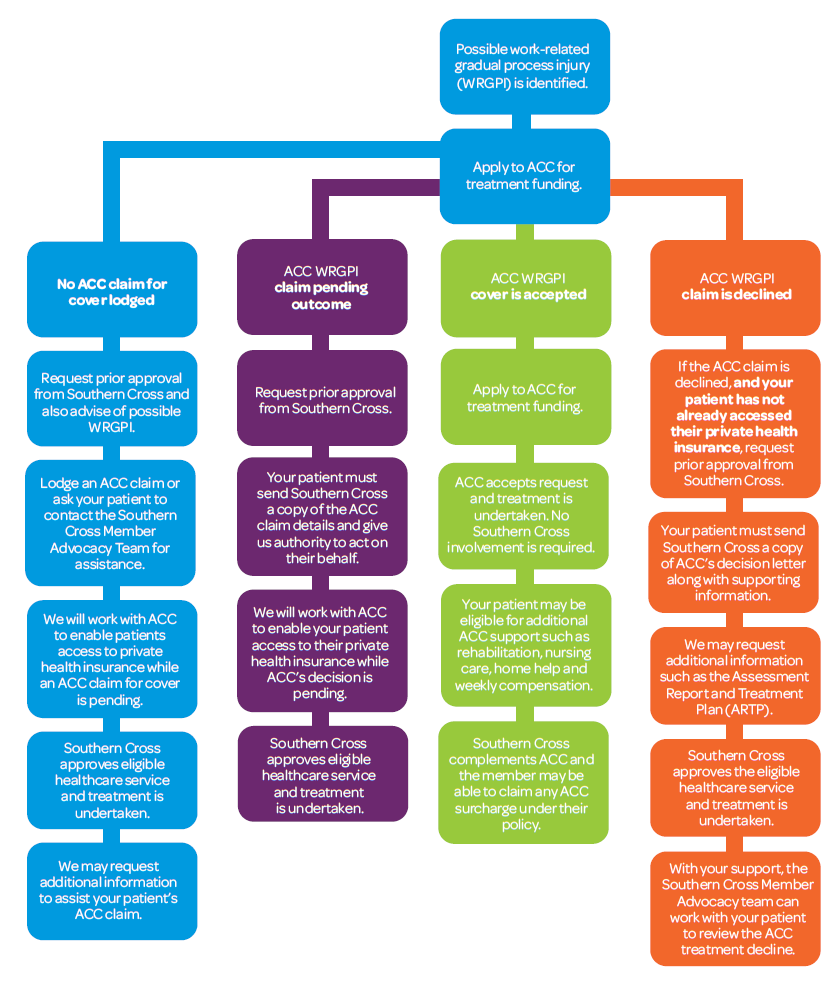

Work related gradual process (WRGPI)

Work-related gradual process injuries are health conditions such as injuries, diseases, or infections that develop gradually over time due to the cumulative effects of work-related tasks or environments. These conditions arise when the physical or psychological demands of a job contribute to or directly cause harm to the body, often through repetitive motion, sustained postures, overexertion, or prolonged exposure to hazardous conditions.

If ACC declines to cover a TI for Southern Cross members

Occasionally, a patient receives an unexpected injury during treatment or surgery. A TI is defined in the Accident Compensation Corporation Act 2001 as “a physical injury suffered during treatment from a registered health professional that was caused by that treatment and is not a necessary part or ordinary consequence of that treatment.” ACC is the "first insurer" for such injuries and is therefore legally responsible for the treatment costs of a TI. For more information visit the ACC website.

Unlike PICBA, ACC does not require a claim to be lodged or a decision on cover or treatment funding to be made before a patient can have treatment. This reflects the fact that TIs often need urgent treatment and it would not always be possible or appropriate to lodge a claim or request for prior approval prior to treatment. However, if a claim has been accepted by ACC, approval for treatment funding must be sought from ACC before treatment can take place.

TIs can be complex, and it is often difficult to determine whether a particular injury meets ACC’s criteria for cover. If you have any questions about whether your Southern Cross patient may have a TI, you can contact the Southern Cross treatment injury case managers for advice at [email protected].

Contact the Southern Cross member advocacy team

If you have any questions about this process, please contact the Southern Cross member advocacy team at [email protected]